CONTACT

SIGN UP

PREMIUM BDC REPORTS

- Dividend sustainability and projections for each BDC

- BDC rankings and pricing

- Suggested BDC portfolios

- My personal BDC holdings/allocations

- BDC Risk Profiles

- Interest rate sensitivity comparison

- Pricing charts for each BDC with suggested ‘buy pricing’

INDIVIDUAL BDC PROJECTIONS

- Discussion of results and management

- Portfolio credit issues

- Best – Base – Worst case scenarios

- Optimal Leverage Analysis

- Lower Yield Analysis

- Discussion & notes from earnings call

OTHER REPORTS

- Interest Rate Sensitivity

- BDC Portfolio Returns

- Quarter Earnings Analysis

- BDC Buzz Positions

DIVIDEND COVERAGE

LEVELS REPORT

- Updated Weekly

- Rankings of projected coverage

- Running list of changes and reasons

BDC PRICING REPORT

- Multiples / Yield – Based / Total Return

- Suggested Buys

- Pricing Charts

BDC RISK PROFILES

- Quality of platform / management

- Exposure: Oil, commodities, CLOs

- Historical credit performance

- NAV stability / growth

- Reaching for yield / dividend coverage

SUGGESTED PORTFOLIOS

- Total Return

- Recommended Higher Yield

- High – Yield

- Risk Averse

OVERALL BDC RANKINGS

- Dividend Coverage

- Risk Proles

- Pricing & Valuation

- Expected Returns

BDC Buzz Positions

- Current holdings & allocations

- Real-time announcements

- Potential upcoming purchases

- List of previous changes

Please allow up to 24 hours (on weekends and holidays) to receive

information to access all reports or links. E-mail me directly if

you have questions: bdcbuzz@gmail.com

BDC PREMIUM REPORTS

Individual BDC Deep Dive Reports

(16 to 30 pages) – Taking into account updated portfolio intelligence, operating results, latest debt, and equity offerings as well as any preliminary results released by the company, I first focus on changes that might negatively impact dividend coverage and, if needed, make updated recommendations before markets open the next day. These reports include:

- Base case projections over the next three quarters

- Best and worst case projections

- Potential for dividend changes (increased/decreased) and/or special dividends

- Interest rate sensitivity analysis (100, 200, 300 basis points)

- Leverage and lower yield dividend coverage analysis (based on current capital structure)

- Future equity offering forecasts

Special Reports

Address specific issues or provide general rankings and side-by-side analysis:

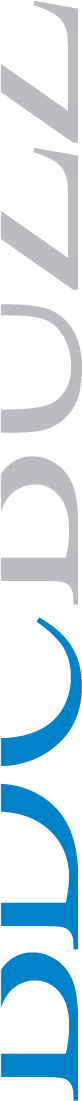

Suggested BDC Portfolios

- Risk-averse

- Total return

- Recommended higher yield

- High-yield

Suggested BDC Portfolios

- Risk (portfolio credit quality and vintage, quality of management, historical credit, and NAV performance, portfolio diversification, repayment exposure, rate sensitivity, effective leverage ratios, the “need to reach for yield” to sustain dividends)

- Profitability (historical and projected dividend coverage, yield compression sustainability, prepayment potential, recurring vs. onetime income, PIK vs. cash, NII growth/decline, operation cost efficiency)

- Return (regular and special dividends, sustainable and growing, NAV growth)

- Valuation (NAV, earnings, growth rates, total return, appropriate yields)

Dividend Coverage Levels

- Base, best and worst case performance scenarios

- Optimal leverage and portfolio yield analysis

- Fee structures, operational and borrowing expenses

- Historical performance

BDC Pricing & Charts

- Appropriate yield for risk and dividend coverage levels

- NAV and earnings multiples

- Risk-adjusted total returns

BDC Risk Profiles

- Comparison of “true” first-lien

- Exposure to oil/energy, CLOs, SLPs, and subordinated debt

- Reaching for yield vs. strong dividend coverage

- Quality of management measures

- Shareholder alignment and fee structures

- Portfolio vintage analysis

Interest Rate Sensitivity Comparison

- Compares the impact to each BDC for 100, 200, 300 basis point rate increases

My Personal BDC Positions

- Current holdings and allocations

- Real-time announcements of changes to my portfolio

- Potential upcoming purchases/sales and pricing

- List of previous changes to my portfolio

New BDCs Added To Coverage

- Pricing, projections, risk, and returns before discussing in

public articles

There are currently around 40 reports available including full analysis for 24 BDCs (currently AINV, ARCC, CCT, CGBD, FDUS, FSC, FSIC, GBDC, GLAD, GSBD, HTGC, MAIN, MCC,MRCC, NMFC, PFLT, PNNT, PSEC, SUNS, TCAP, TCPC, TCRD, TPVG, and TSLX).

GOOGLE SHEETS / SAMPLE VIEWS

- Currently, there are various worksheets as shown below including Suggested BDC Portfolios, BDC Ranking Tiers, and Baby Bonds. BDC pricing can be volatile and Google Sheets tracks real-time changes to pricing compared to my price targets so that investors can

make quick decisions.

- Recommendation Categories: After investors have identified BDCs that fit their risk profile,

I categorize investors’ needs for each BDC holding using the following:

DESCRIPTIONS:

- Investors looking to start a position. Dipping your toe in.

- Investors looking to grow a position to an appropriate allocation.

- Investors looking to opportunistically add to a position beyond an appropriate allocation.

GOALS:

- Mostly for dividend income.

- Dividend income + 5% capital gains within 12 months.

- Dividend income + 10% capital gains within 12 months.

- This is for investors that do not currently have a meaningful position in a certain BDC and would like to “dip their toe in” with a starter position and then continue to buy more on the dips. I suggest buying a small number of shares closer to its target price.

- This is for investors that already have smaller positions and would like to grow them to a proper allocation for a diversified portfolio. I suggest adding to these positions at prices closer to 5% below its target price as I recently did with TCP Capital (TCPC) due to favorable pricing during its recent equity offering as discussed in “TCPC Equity Offering: Is It Still A Buy?”.

- This is for investors that already have full positions and would likely only add at opportunistic prices of around 10% below target prices. Active traders might choose to sell these shares for capital gains at a later date to re-balance the portfolio.

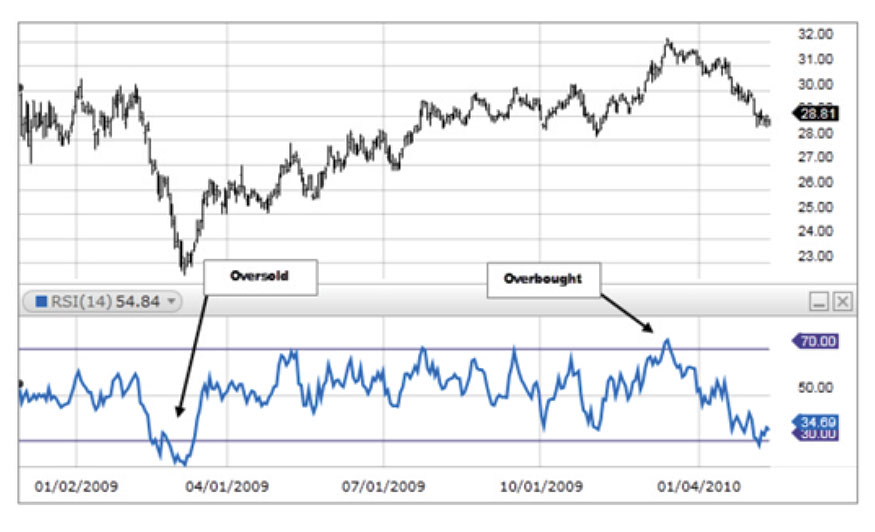

Relative Strength Index (RSI):

“The relative strength index (RSI) is a momentum indicator developed by noted technical analyst Welles Wilder, that compares the magnitude of recent gains and losses over a specified time period to measure speed and change of price movements of a security. It is primarily used to attempt to identify overbought or oversold conditions in the trading of an asset. Traditional interpretation and usage of the RSI is that RSI values of 70 or above indicate that a security is becoming overbought or overvalued, and therefore may be primed for a trend reversal or corrective pullback in price. On the other side of RSI values, an RSI reading of 30 or below is commonly interpreted as indicating an oversold or undervalued condition that may signal a trend change or corrective price reversal to the upside.”

This is a complicated formula because it takes into account changes in daily pricing over a rolling 365 days which takes time to process (as the price changes). I have not found this indicator available in table format with other online services.

I have color coded the RSI values with green showing closer to 30 (indicating oversold), yellow showing near 50 and red showing closer to 70 (indicating overbought). I include a chart with stock pricing and RSI in my “deep dive” reports on each BDC and I have made

many purchases (for safer BDCs) when RSI is closer to 30.

Trading Volume:

I have found a way to measure the average volume being traded for all BDCs to see if it is an active or slow trading day for the sector and then look at individual BDCs to see if they are trading above or below that average (given the time of day).

This is important because investors should know when volumes might be indicating something meaningful is going on with the stock, whether positive or negative.

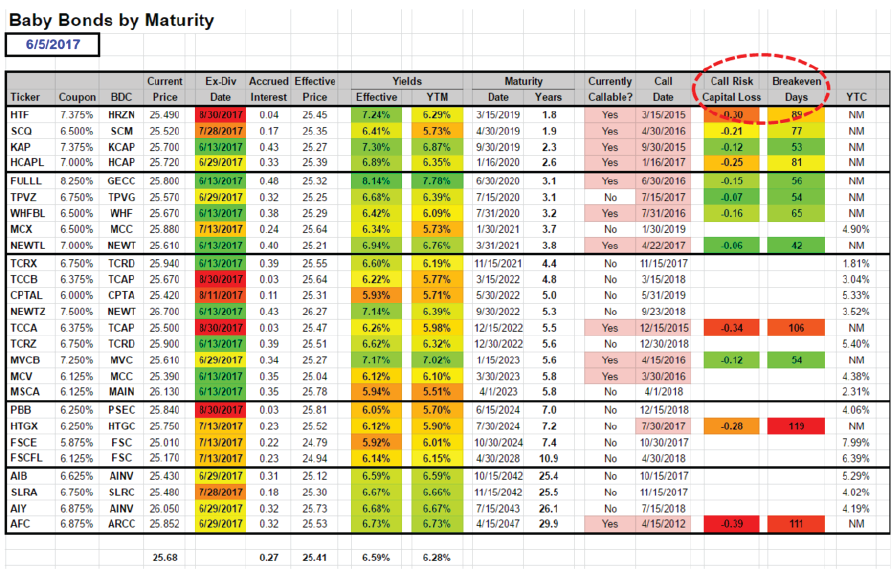

“Baby Bond” Sheet:

![]()

Investors should use limit orders when purchasing exchange-traded debt such as Baby Bonds.

BDC Baby Bonds trade “dirty” which means that there is a certain amount of accrued interest in the market price. I have included the amount of accrued interest that updates daily.

You need to own the Baby Bond one trading day before the ex-dividend date to be eligible for the full quarter of interest.

It is important to take into account which BDCs are “callable” and the potential for capital losses during the worst case scenario.

The Call Risk Capital Loss column refers to the worst case scenario of a bond being called tomorrow (if currently callable) and takes into account 30 days of additional interest accrued before being redeemed. See below.

Breakeven Days refers to the number of days of interest needed to break-even given the current market price. See below. Type your paragraph here.